Digital Microfinance

We Even Take Care of your small finances

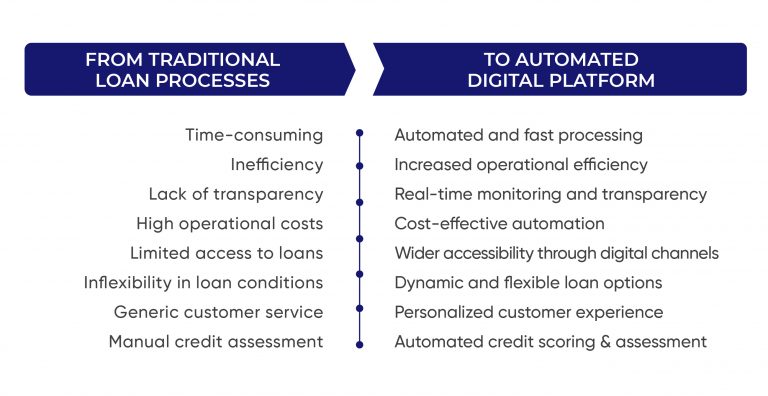

Our platform is designed to be flexible and customizable, allowing Microfinance institutions to tailor it to their specific needs and business processes. It can be integrated with other systems, such as accounting and CRM, to provide a comprehensive solution for MFIs.

Faster and better even for your micro-financial decisions

Minimize friction and free your customers from tedious manual tasks with a fully digital experience even when it comes to your micro-finances.

Digital

Consumer Onboarding

Ensuring not only the initial customer touchpoint is completely digital and fully compliant with a robust eKYC but also the financial institution’s employees and agents.

Offering the consumer, a sped-up acquisition process by automating identity verification and validation. Our digital engagement platform's AI document scanning is not only efficient but also extremely secured.

Offering the bank’s agent a well-structured dashboard equipped with all the tools and features needed to boost and maximize the agent’s performance and visibility.

Loan Automation

Consumer Finance

Our fully integrated digital banking solution, allowing financial institutions to differentiate themselves and innovate.

Deliver fast and frictionless experiences to your customers while lowering costs and driving conversions and revenue throughout our platform.

Shariah-compliant financing for instance, is one of the specific offerings for our clients. In this sense, we developed products suitable for Islamic banks to give their consumers the freedom to choose an appropriate and personalized payment plan.

Cutting-Edge AI Methods

Digitization Of Know Your Customer (KYC)

Personalization Of The Client’s Journey

Risk Analysis Models

Client-Provided Public Data

Financial Behavior Analysis

Our Benefits and Features

Analytics And Reporting Via Dashboards

Banking the Unbanked

Strengthening Employees With Automation

Insights and Analytics

We offer powerful insights and analytics features to help financial institutions better understand their clients and make informed business decisions.

Loan Performance Monitoring

Monitor the performance of loans and track repayment rates, default rates, and other key metrics in real-time.

Customer Insights

Gain a deeper understanding of customer behavior, including transaction history, savings habits, and borrowing patterns.

Financial Trends

Identify and track financial trends and market movements to inform business decisions and investment strategies.

Portfolio Management

Manage and optimize the loan portfolio to maximize return on investment and minimize risk.

Data Visualization

Present data in interactive and easy-to-understand visualizations to support data-driven decision-making.

Credit Scoring

Automatically evaluate credit risk and determine the likelihood of loan repayment based on customer data and behavior.

Loan Servicing

Manage the administration of a loan, from disbursing the funds

to collecting payments and maintaining records.

The loan servicer is responsible for disbursing the loan funds to the borrower according to the loan agreement.

The loan servicer communicates regularly with the borrower regarding the loan balance, payment schedule, and any other important information.

If the borrower requests a loan modification, the loan servicer is responsible for processing the request and updating the loan terms as necessary.

The loan servicer maintains records of all loan transactions, including payments, interest charges, and any other changes to the loan.

The loan servicer is responsible for collecting payments from the borrower, including both principal and interest payments.

In the event of a missed or late payment, the loan servicer is responsible for taking steps to collect the overdue amount and prevent default.

The loan servicer applies payments made by the borrower to the loan balance, and updates the borrower's account accordingly.